Dubai’s real estate market maintained its upward trajectory in the first quarter of 2025, according to the latest report from dubizzle, the UAE’s largest classified platform.

The report highlights increased investor confidence, tourist numbers and government initiatives as key factors driving the market’s performance across luxury, mid-tier and affordable segments.

“Dubai’s real estate market has sustained its upward trajectory in Q1 2025, with demand for ready properties reaching new heights and the off-plan sector continuing to thrive. Investor confidence remains exceptionally strong, driven by favourable market conditions, high rental yields and strategic government initiatives that have cemented Dubai’s position as a global investment hub. As the sector evolves, dubizzle commits to enhancing market transparency and providing data-driven insights as crucial elements in shaping informed decision-making and fostering long-term growth,” said Haider Khan, CEO of dubizzle and Dubizzle Group MENA.

Dubai property market records strong Q1 2025 performance across all segments

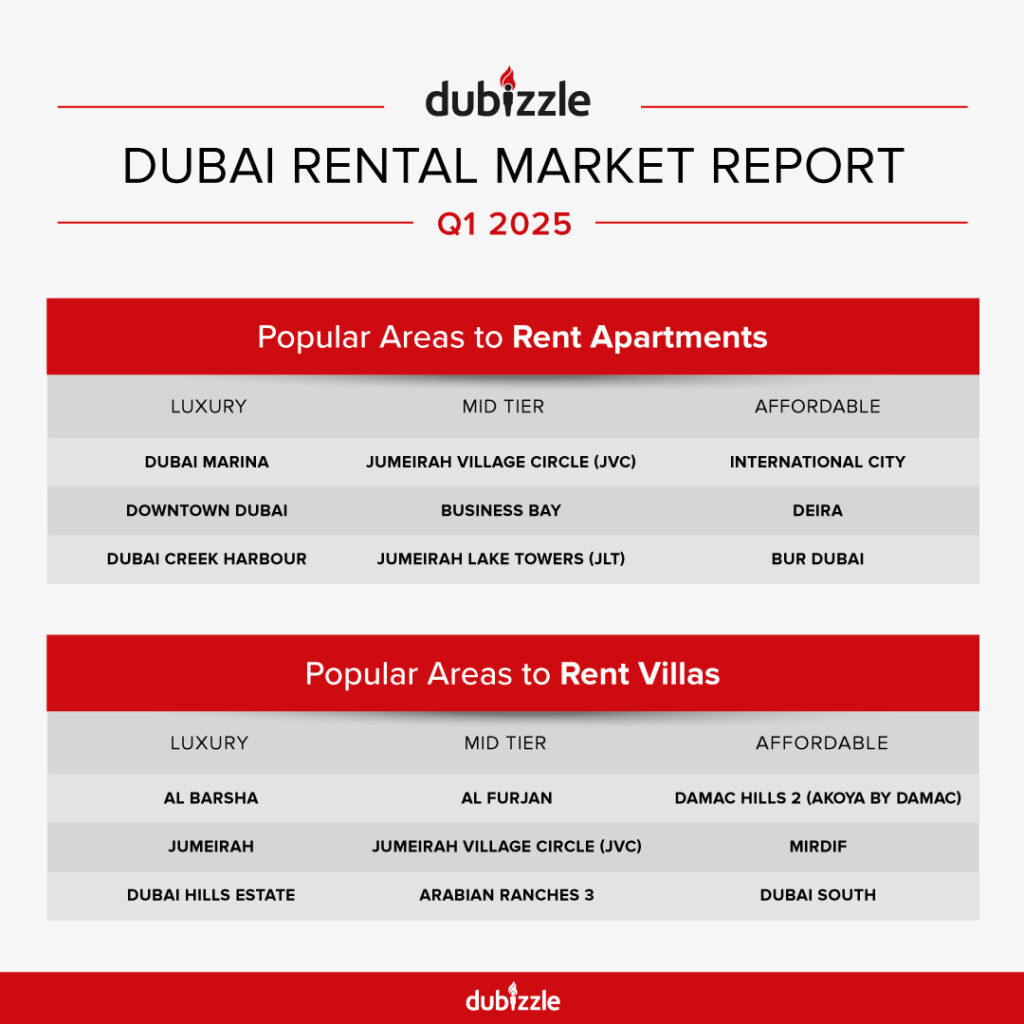

Dubai Marina remains the top destination for luxury apartments with an average sales price of AED 2.52 million and rental prices averaging AED 139,000 annually. The area recorded a return on investment (ROI) of 5.84 percent.

For luxury villas, Dubai Hills Estate leads with an average sales price of AED 17.77 million and an ROI of 4.41 percent. Palm Jumeirah follows with villas averaging AED 47.48 million and a 3.63 percent ROI.

In the rental market, Al Barsha commands the highest average rent for luxury villas at AED 448,000 per year, followed by Jumeirah at AED 420,000.

Jumeirah Village Circle (JVC) dominates the mid-tier apartment segment with an average sales price of AED 1.18 million and annual rent of AED 79,000. The area offers investors a 7.38 percent ROI.

For mid-tier villas, Al Furjan tops the list with an average sales price of AED 5.8 million and rental prices of AED 322,000 annually, delivering a 5.69 percent ROI.

Other popular mid-tier areas include Business Bay and JLT for apartments, with Arabian Ranches 3 gaining traction for villas.

Affordable housing market shows strong investment returns in Q1

In the affordable segment, Dubai Silicon Oasis leads apartment sales with an average price of AED 1.03 million, while International City offers the lowest average rent at AED 52,000 per year.

DAMAC Hills 2 (formerly Akoya by DAMAC) emerges as the top choice for affordable villas with an average sales price of AED 1.96 million and rental rates of AED 118,000 annually. The area provides a 7.14 percent ROI for investors.

Dubai Investments Park stands out for investment returns, with affordable apartments yielding 8.79 percent ROI and villas an impressive 12.16 percent.

The off-plan sector continues to attract investors. For luxury apartments, Elvira in Dubai Hills Estate offers units averaging AED 2.5 million, while St. Regis The Residences in Downtown Dubai targets the ultra-luxury segment with prices starting at AED 4.28 million.

In the mid-tier off-plan segment, Binghatti Skyrise in Business Bay averages AED 1.7 million for apartments, while Wind Towers in JLT offers units around AED 700,000.

For affordable off-plan apartments, Verdana Residence in Dubai Investments Park averages AED 607,000, while 48 Parkside in Arjan averages AED 1.62 million.

In the villa segment, DAMAC Lagoons’ Venice project leads luxury off-plan options starting at AED 6.77 million, while Farm Grove in The Valley by Emaar averages AED 5.21 million.

Arabian Ranches 3 remains popular for mid-tier off-plan villas with projects like Anya averaging AED 2.91 million. For affordable options, R. Hills in Dubailand starts at AED 2.11 million, while Verdana 2 in Dubai Investments Park averages AED 1.26 million.