Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) is in talks to sell HomeServices of America, its real estate brokerage arm, to Compass (COMP), according to the Wall Street Journal. This move stands out because Buffett rarely sells major businesses, preferring to hold them for decades. If the deal goes through, it would mark a rare shift from Berkshire’s usual “buy and hold” approach.

Light Up your Portfolio with Spark:

The talks between Berkshire and Compass are ongoing, and no final agreement has been reached. Notably, this comes as Berkshire’s stock has climbed 11% this year, far outperforming the S&P 500’s (SPX) 4.8% drop.

HomeServices Faces Legal Troubles and Financial Losses

HomeServices of America has been under growing legal and financial pressure. In 2024, the unit reported a $107 million loss, driven by a $250 million settlement linked to lawsuits accusing the real estate industry of inflating commission fees.

Rising legal risks and ongoing losses may be pushing Berkshire to reconsider its place in the real estate market.

Is This a Shift in Berkshire’s Strategy?

If the sale happens, it could signal a broader change in Buffett’s long-standing strategy. With Greg Abel expected to take over as the CEO of Berkshire Hathaway, offloading HomeServices might streamline Berkshire’s massive business portfolio.

At the same time, the real estate market faces headwinds, including rising home prices, higher mortgage rates, and legal disputes. Selling the unit would allow Berkshire to exit a volatile industry and focus on businesses with steadier cash flow.

Is BRK.B a Good Buy Right Now?

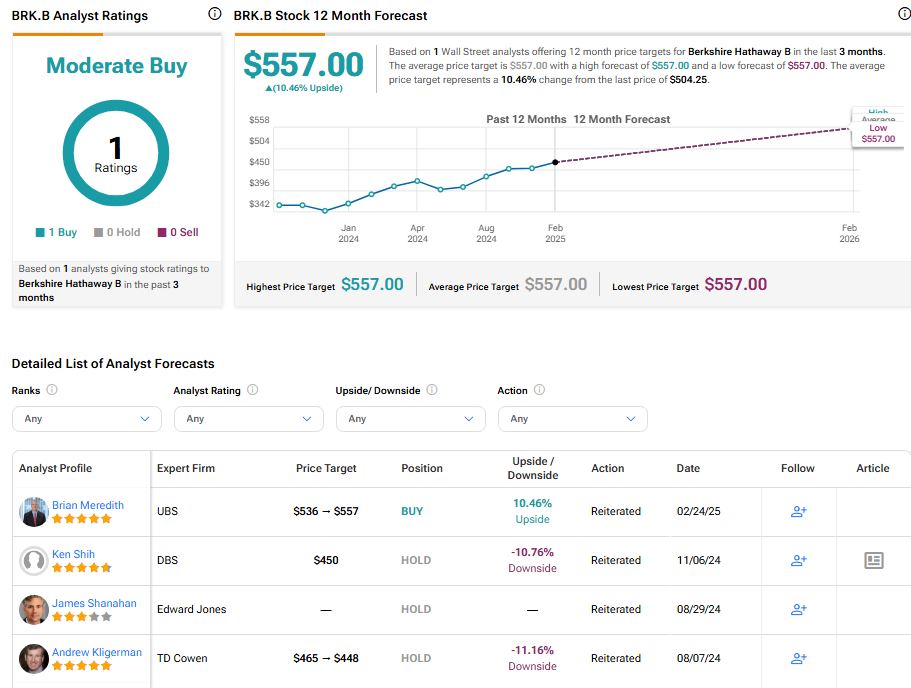

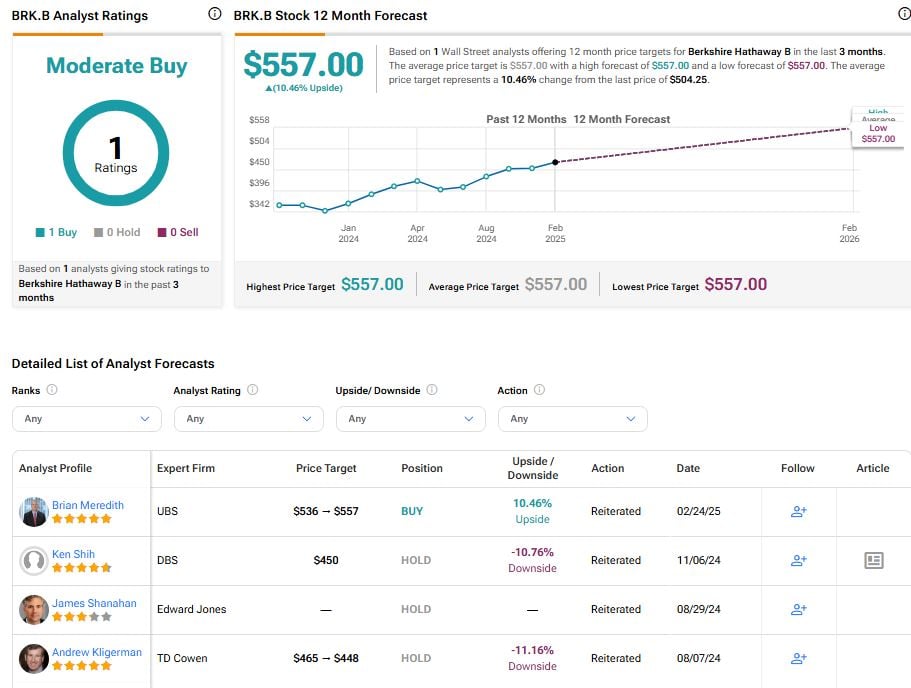

Berkshire Hathaway’s Class B stock currently has a Moderate Buy rating based on one Buy recommendation issued in the past three months. The average BRK.B price target of $557 implies 10.46% upside from current levels.

Source link