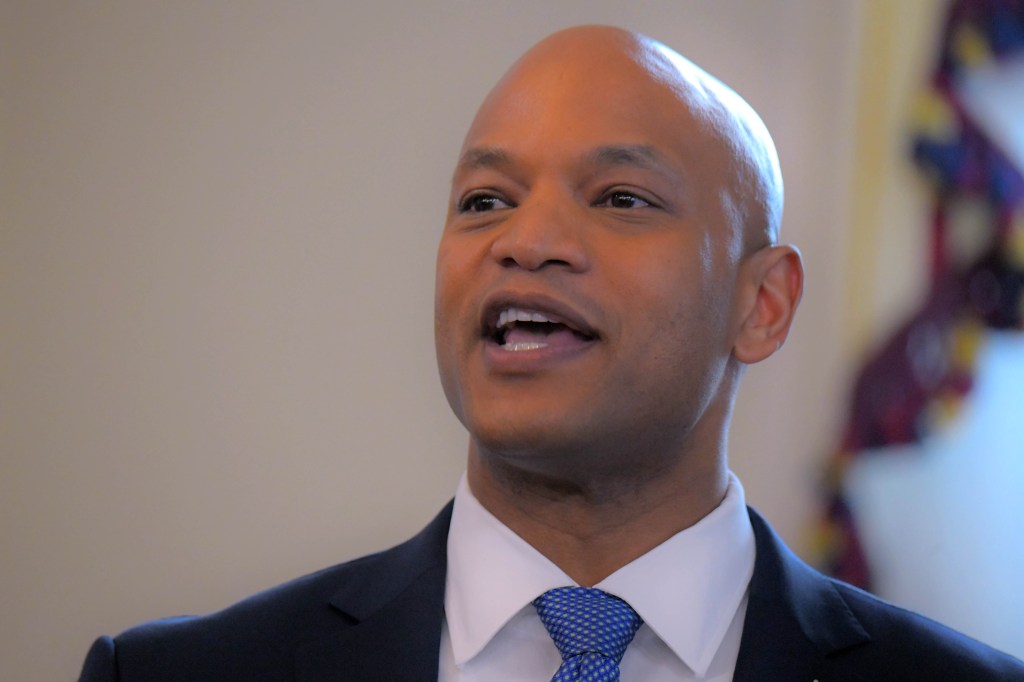

Three cheers for Gov. Wes Moore as he reduces the state’s bloated inventory of office buildings and other facilities in Baltimore (“Moore administration trims Baltimore real estate portfolio, other spending to cut $576M,” June 6). This will be a win for taxpayers as these economies help the state government address its structural deficit and more efficiently allocate scarce income and assets.

Eventually, it will also put some added revenue into city coffers, as these sales get currently tax-exempt properties into private hands and put them onto the property tax rolls.

Over a third of the city’s real property is in the hands of government and non-profit entities that are tax-exempt, limiting Baltimore’s tax base and, therefore, adding to the heavy burden on city businesses and home-owners. Indeed, this plan is so appealing one can only hope the governor plans to scale it up in the future.

There are, for example, a couple of very valuable state-owned facilities in Camden Yards that are currently occupied by wealthy, high-profile tenants. One wonders how many tens (or hundreds?) of millions those tenants might pay to obtain complete control over these facilities so that they could devise creative new ways to generate more income from them without having to negotiate those plans with a landlord.

— Stephen J.K. Walters, Baltimore

Add your voice: Respond to this piece or other Sun content by submitting your own letter.