How to Rent a House for the First Time: The Complete Guide

To rent a house for the first time, start by assessing your budget and rental needs, researching state-specific tenant rights, and preparing a digital “renter’s portfolio” for the application process. This comprehensive guide by KT Rents covers every step—from finding verified listings to understanding standard property inspections—so you can navigate your first lease with total confidence.

Introduction: The Modern Renter’s Roadmap

Renting a home offers a blend of flexibility and privacy that apartments often can’t match. However, the U.S. rental market in 2026 is competitive and driven by digital screening. Success requires more than just finding a house; it requires understanding the legal and financial frameworks that protect you. This guide is designed to arm you with practical expertise that goes beyond generic advice.

Who This Guide is For Whether you’re relocating for a career, downsizing, or moving out on your own for the first time, this guide is for anyone asking: “How do I rent a house in a market I don’t yet understand?” Knowledge is your greatest asset, and KT Rents is dedicated to providing the professional insight you need.

Key Challenges for First-Time Renters

- Navigating state-specific rental regulations and tenant protections.

- Understanding how local school districts and amenities drive market pricing.

- Identifying legitimate rental listings versus increasingly sophisticated scams.

- Compiling a digital-ready application package for modern property managers.

Direct Answer: For first-time renters, success comes down to three elements: familiarizing yourself with Fair Housing laws, accurately budgeting for all monthly expenses (including renter’s insurance), and thoroughly vetting both properties and landlords for legitimacy.

Step 1: Assess Your Rental Needs and Budget

Setting a Realistic Monthly Budget Start with your gross monthly income. Most experts suggest your rent should not exceed 30% of your pre-tax pay. Factor in additional costs that are often excluded from the base rent: utilities, renter’s insurance (mandatory in most 2026 leases), and commuting expenses.

Identifying Must-Have Features vs. Nice-to-Haves Create a hierarchy of needs. Essentials might include pet-friendliness, a minimum number of bedrooms, or ADA compliance. Aspirational features might include high-end appliances or a fenced-in yard. This helps you act quickly when a property meets your core criteria.

Factoring in Total Cost of Occupancy Don’t overlook hidden costs like seasonal lawn care, snow removal (in northern climates), or pest control fees. Verify which maintenance tasks are your responsibility before signing the lease.

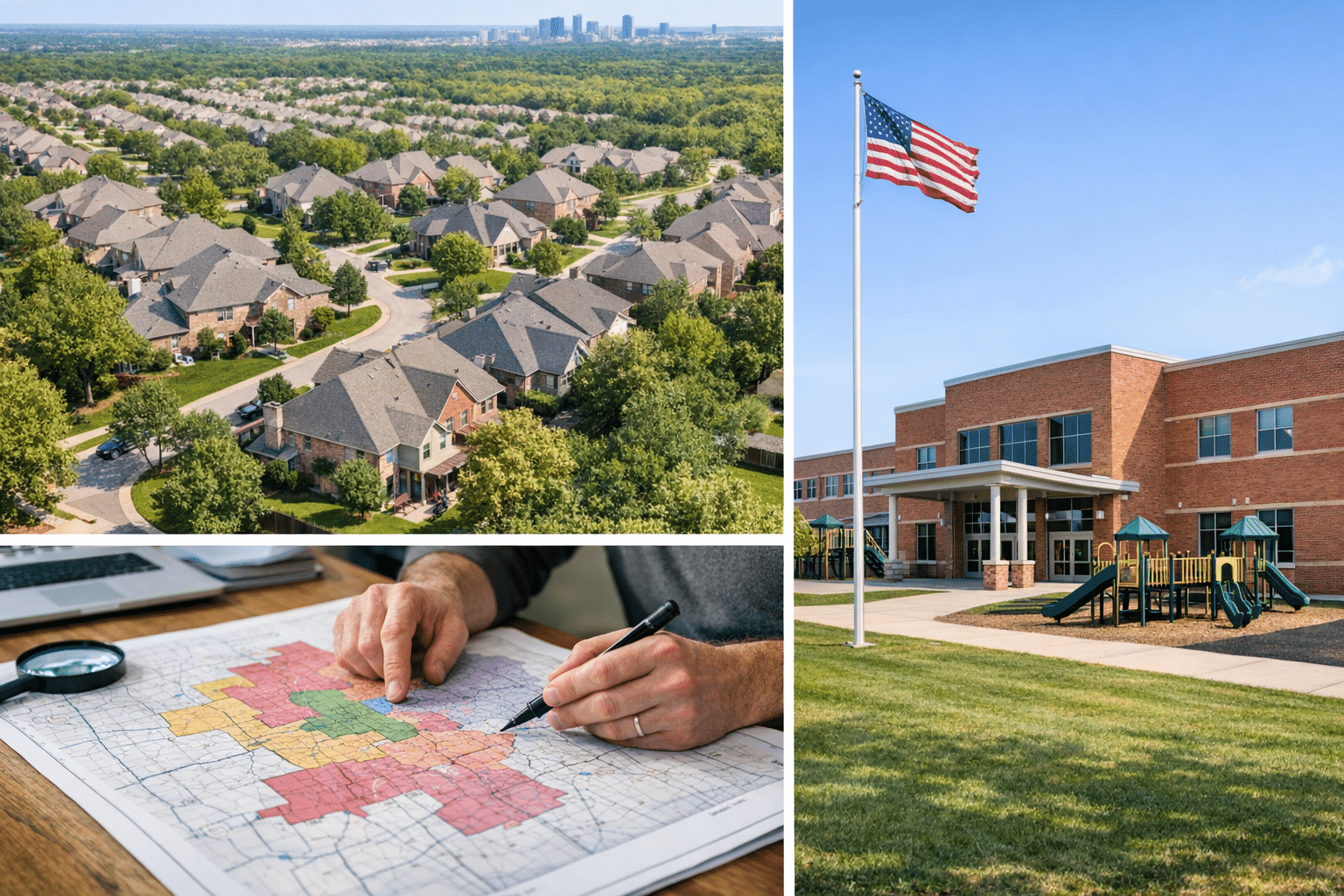

Step 2: Researching Markets and Neighborhoods

How Location Impacts Value Rental prices fluctuate based on local demand. Highly rated school districts and proximity to major job centers or transit hubs typically command higher rents and see lower vacancy rates. Even if you don’t have children, being aware of these boundaries helps you understand price jumps between adjacent neighborhoods.

Commute and Lifestyle Considerations Research local amenities like grocery stores, parks, and medical facilities. Factor in your daily commute—simulating the drive during peak hours on a GPS app is a best practice.

Step 3: Understanding Rental Regulations and Tenant Rights

Federal and State Laws Every renter is protected by the federal Fair Housing Act, which prohibits discrimination based on race, religion, sex, disability, and more. Beyond federal law, each state has its own statutes regarding security deposit limits, eviction processes, and “implied warranty of habitability.”

Property Inspections: What to Expect Reputable landlords ensure their properties meet local health and safety codes (smoke detectors, egress windows, heating/electrical standards). Always ask for proof of a recent inspection or a “Certificate of Occupancy” where required by law.

Step 4: Searching and Avoiding Scams

Best Platforms for Verified Listings While national aggregators are useful, the most accurate inventory is often found directly on the websites of established property management firms like KT Rents.

Red Flags to Watch For

- Landlords unwilling to meet in person or via verified video call.

- Demands for wire transfers or “holding fees” before a tour.

- Listings priced significantly below the local market rate.

- Requests for sensitive personal info (SSN) on a non-secure platform.

Step 5: The Application Process in 2026

Tenant Screening: What Landlords Look For Modern landlords assess three main pillars: Credit History (financial responsibility), Income-to-Rent Ratio (usually 3:1), and Rental History (references from previous landlords).

Essential Paperwork Ready-List

- Government-issued ID.

- Recent pay stubs or proof of income (last 2–3 months).

- Bank statements (to show proof of funds for the deposit).

- Reference contacts (employment and prior housing).

Step 6: Reviewing and Signing the Lease

Key Terms to Understand Read every word. Pay attention to the lease duration, renewal options, maintenance division (who handles what), and penalties for late payments. Ensure all verbal promises (like “we will paint the bedroom”) are added as a written Lease Addendum.

Common Fees and Deposits Expect a security deposit (typically 1–2 months’ rent) and potentially a pet deposit or monthly “pet rent.” Always get a receipt for any funds exchanged and a written “Move-In Condition Report.”

Conclusion: Renting with Confidence

Renting your first home is a business transaction. By knowing your budget, verifying your landlord’s legitimacy, and insisting on written documentation, you protect your rights and your wallet.

Connect with KT Rents for Expert Guidance Ready to take your next step? Tap into our expertise—our team doesn’t just show houses; we empower first-time renters. Explore our curated listings or review our detailed guide on Renting vs. Buying to see which path is right for you in today’s market.